WMMC Primary Services

Family Practice Clinics

Internal Medicine Clinics

Pediatrics

Make a difference today and save on taxes. It’s possible when you support the Western Missouri Medical Center through your IRA.

You can give any amount (up to a maximum of $100,000) per year from your IRA directly to a qualified charity such as Western Missouri Medical without having to pay income taxes on the money. Gifts of any value $100,000 or less are eligible for this benefit and you can feel good knowing that you are making a difference at WMMC. This popular gift option is commonly called the IRA charitable rollover, but you may also see it referred to as a qualified charitable distribution, or QCD for short.

(Charitable donations made to Western Missouri Medical Center are receipted by the Western Missouri Medical Center Foundation, a tax-exempt organization under sections 501(c)(3) and 509(a)(3) of the Internal Revenue Code with Federal Identification Number 43- 1463861.)

If you’re at least 59½ years old, you can take a distribution and then make a gift from your IRA without penalty. If you itemize your deductions, you can take a charitable deduction for the amount of your gift.

No matter your age, you can designate Western Missouri Medical Center as the beneficiary of all or a percentage of your IRA and it will pass to us tax-free after your lifetime. It’s simple, just requiring that you contact your IRA administrator for a change-of-beneficiary form or download a form from your provider’s website.

Tip: It’s critical to let us know of your gift because many popular retirement plan administrators assume no obligation to notify a charity of your designation. The administrator also will not monitor whether your gift designations are followed. We would love to talk to you about your intentions to ensure that they are followed. We would also like to thank you for your generosity.

Legal Name: Western Missouri Medical Center

Legal Address: 403 Burkarth Rd, Warrensburg, MO 64093

Federal Tax ID Number: 44 – 0665266

No. You must be 70½ by the date you make the gift.

Yes. Direct gifts to a qualified charity can be made only from an IRA. Under certain circumstances, however, you may be able to roll assets from a pension, profit sharing, 401(k), or 403(b) plan into an IRA and then make the transfer from the IRA directly to Western Missouri Medical Center. To determine if a rollover to an IRA is available for your plan, speak with your plan administrator.

Yes, absolutely. Beginning in the year you turn 73, you can use your gift to satisfy all or part of your RMD.

No. You can give any amount under this provision, as long as it is no more than $100,000 per year. If your IRA is valued at more than $100,000, you can transfer a portion of it to fund a charitable gift.

We must receive your gift by Dec. 31 for your donation to qualify this year. If you have check-writing features on your IRA, please be aware that your check must clear your account by Dec. 31 to count toward your required minimum distribution for the calendar year.

No. Under the law, you can give a maximum of $100,000 per year. For example, you can give each organization $50,000 this year or any other combination that totals $100,000 or less. Any amount of more than $100,000 in one year must be reported as taxable income.

If you have a spouse (as defined by the IRS) who is 70½ or older, they can also give any amount up to $100,000 from their IRA.

Yes! If you are 70½ or older, you may now make a one-time election for a qualified charitable distribution of up to $50,000 (without being taxed) from your IRA to fund a life-income gift. Some limitations apply, so contact us for more details and a personalized illustration at no obligation.

By making a gift this year of any amount up to $100,000 from your IRA, you can see your philanthropic dollars at work. You are jump-starting the legacy you would like to leave and giving yourself the joy of watching your philanthropy take shape. Moreover, you can fulfill any outstanding pledge you may have made by transferring that amount from your IRA as long as it is $100,000 or less for the year.

WMMC is a not-for-profit organization, and having support from the WMMC Foundation is critical. Not only does the Foundation help support the hospital by providing community awareness, but it also takes a huge step in helping raise funds to allow WMMC to continue providing the best care in the Johnson County region.

Put more simply, just like a house has a concrete foundation to hold it up and support it physically, a hospital foundation contributes financially to help hold up WMMC by providing resources needed for WMMC to stay on the cutting edge with the most efficient equipment, programs, and services that otherwise might not be possible.

Yes. The Foundation is necessary. Government funding is not sufficient to provide all the required equipment, technology, services, and programs. The full cost of equipment has always been the responsibility of the Hospital. The funds must come from the people who use the services of the local healthcare system and the Foundation is here to facilitate that giving, purchasing of new equipment/technology, replacing existing equipment, and helping to fund programs. We strive to provide our healthcare professionals with the most up-to-date and highest quality equipment to diagnose and treat all the patients at WMMC.

The WMMC Foundation promotes community awareness and a philanthropic culture to support the WMMC mission to provide high-quality healthcare services that improve the wellness of our greater community.

The work of the WMMC Foundation ensures the availability of modern facilities and the most advanced technology right here at home, without the need to travel for care.

Donations made to the Foundation cover the cost of programs, services, and treatments proven to improve patient outcomes that are not eligible for reimbursement by insurance companies. It allows us to make decisions not according to what makes fiscal sense, but according to what is in keeping with our mission, to improve the health of our greater community by providing quality healthcare services, and exceeding the expectations of those we serve.

WMMC is proud to partner with the community to make the most of every gift, whether large or small, to help provide a superior patient experience for every patient, every family, every day.

Your gifts will enrich lives, save lives, and transform patient care. Your gift to the Foundation has more significance because we are WMMC, one of the region’s best hospitals. To continue to move patient care forward, we need your support — because the help you give now will help ensure the best health care will be there when it’s needed for you or someone you love.

Charitable donations made to Western Missouri Medical Center are receipted by the Western Missouri Medical Center Foundation, a tax-exempt organization under sections 501(c)(3) and 509(a)(3) of the Internal Revenue Code with Federal Identification Number 43-1463861. Your donation is tax-deductible to the full extent provided by law.

No. The Foundation respects the rights and privacy of its donors. The personal information that you provide the Foundation is used solely to process your donation, maintain records of all contributions and keep you informed of the latest news and fundraising initiatives by sending annual reports, newsletters, etc.

Gifts touch every area of our medical center. They help attract the most talented physicians, fund facility expansions and ensure you benefit from the best equipment and technology. When you make a gift, you can designate it to be put to work in areas that matter most to you. Most donors prefer not to designate their gift and trust the Foundation Board of Directors will apply it to the area of greatest need or impact. Donations that are not designated are very important to fulfilling our mission – meeting the most urgent needs of the health system, providing the best possible care, and advancing innovative therapies and programs.

Every gift matters and makes a meaningful difference in the lives of our patients! Your investment in the WMMC Foundation will provide life-saving medical care now and for generations to come. If you are interested in giving to the Foundation, please contact the Communications & Development office at (660) 262-7464.

Funds are raised through many different outlets and donors. A series of fundraising events are held throughout the year to raise funds for hospital equipment. We are very grateful to have the support of our community; countless support from individuals, businesses, services clubs, and other organizations provide the majority of our funding. Donations are made in various forms, for example, in memoriam, in honor, grateful patients, legacy, and estate donations. Thank you once again for the generous support of all those who have contributed to the WMMC Foundation.

The Planned Gifts Committee within the WMMC Foundation is a group of community-focused financial and life planners who are committed to assuring high-quality healthcare is available for all those needing medical care, for generations to come. The Committee’s goal is to grow its “Legacy Circle” giving club in order to help provide Western Missouri Medical Center with the resources it needs to best serve and care for our family, friends, and neighbors within the Johnson County, Missouri area.

Adam Sommer — Chair (Harris, Harris, Sommer, & Peppard, LLC)

Jonna Albert (Jonna Albert Accounting & Tax)

Bill Angle (Angle Law Firm)

Alan Brandt (Edward Jones)

Kathleen Brandt (Edward Jones)

Clark Holdren (Sweeney-Phillips & Holdren Funeral Home)

Drew Shanks (Shelter Insurance)

Kevin Smarr (American Family Insurance – Smarr & Associates)

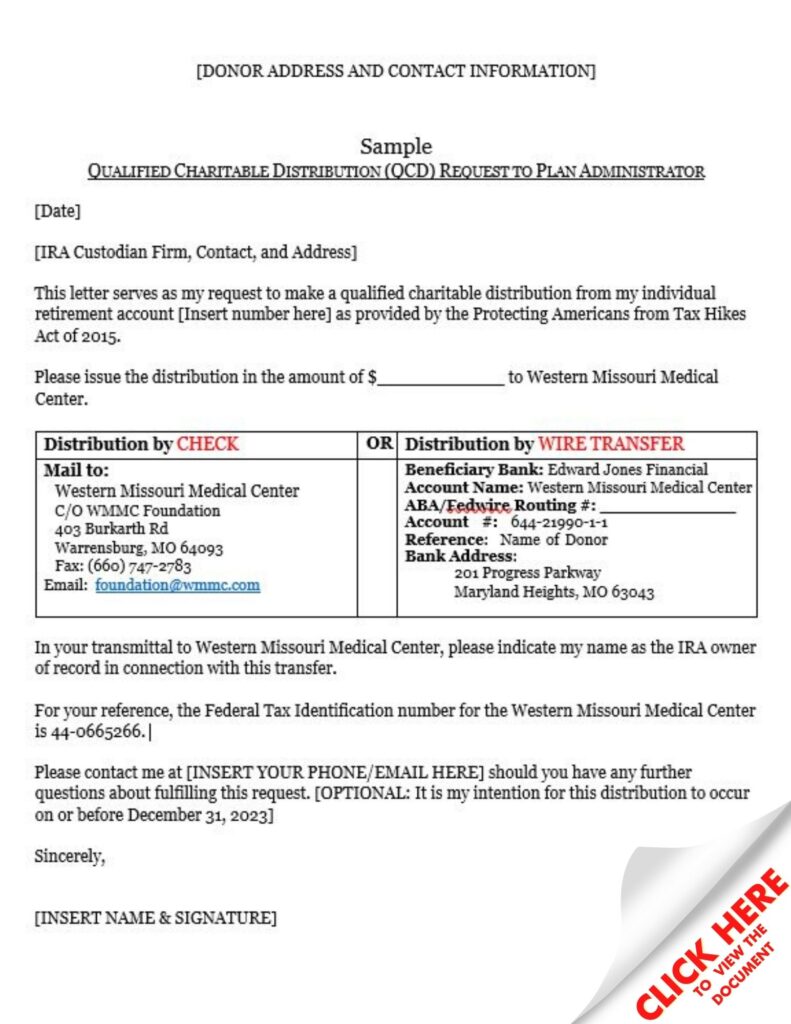

IRA Charitable Distribution Available Through WMMC Foundation